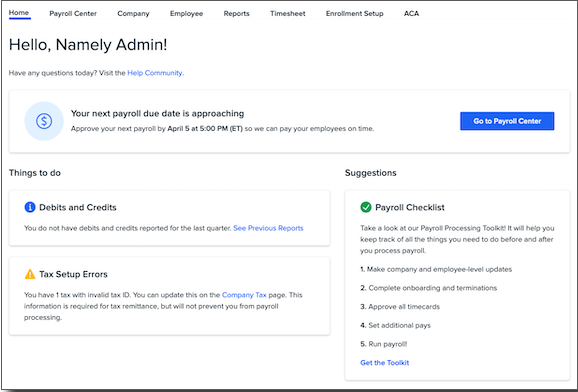

Payroll Dashboard

We've released a new Payroll Dashboard for payroll admins—including information on quarterly debits and credits, tax setup errors, and pending pay cycles.

OVERVIEW

The Payroll Dashboard provides payroll administrators with a home base for all things pay-related. It gives a quick view of important information like:

-

Your next scheduled pay cycle and its submission deadline

-

Quarterly debits and credits that have posted to your account

-

Tax setup errors that could prevent Namely from remitting payments on your behalf

-

A helpful checklist to make sure you're well prepped to kick off your next pay cycle

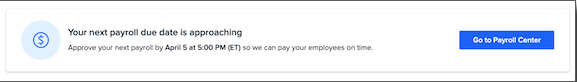

YOUR NEXT PAY CYCLE

At the top of the dashboard, you'll find the submission deadline your next scheduled pay cycle, along with a link to the Payroll Center.

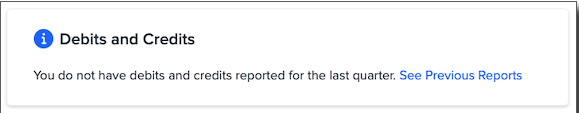

QUARTERLY DEBITS AND CREDITS

Any debits and credits for the most recent quarter will be displayed, along with a link to view previous Tax Variance reports.

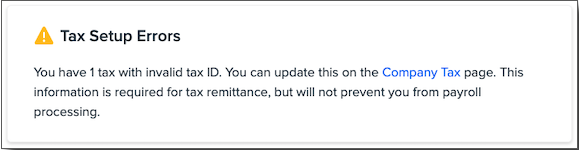

TAX SETUP ERRORS

Any tax setup errors, such as missing or invalid tax IDs, will be displayed, along with a link to the Company Tax page so that they can be corrected. Please note: These errors will not prevent you from processing payroll, but could prevent Namely from being able to successfully remit payments on your behalf, resulting in late fees and penalties.

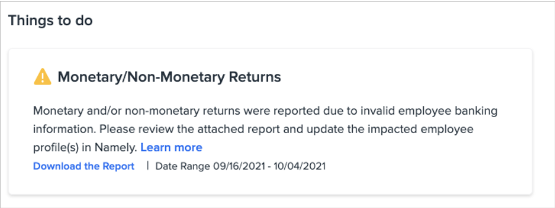

MONETARY AND NON-MONETARY RETURNS

Track issues with employee direct deposits directly on your Payroll Dashboard, as well as view historical data of Monetary and Non-Monetary returns in this report which is refreshed every quarter.

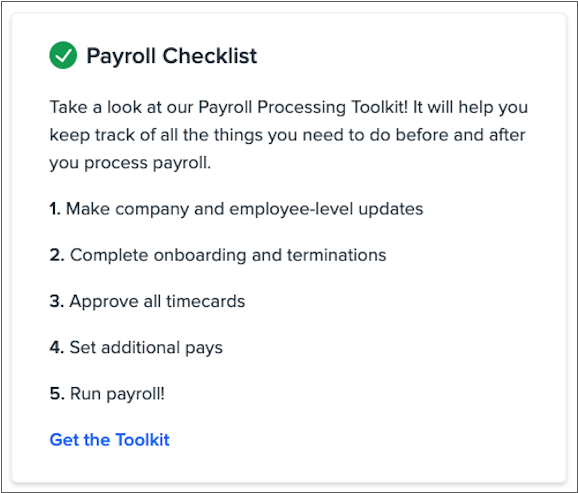

PAYROLL PROCESSING CHECKLIST

We've included a helpful checklist of items to complete before processing your next pay cycle. We've also included a link to our Payroll Processing Toolkit, which will help you keep track of important to-dos before and after processing.